Scammers are using advanced tactics to appear legitimate. Scammers use a ‘fake maker’ to construct a realistic online presence to help sell the scam. They create fake company websites or clone real ones, fake banks with websites, official looking employment documents like offer forms, tax forms, personal information forms, and banking deposit information forms.

In 2022, The Edmonton Police Service received 148 reports of employment scams with a total financial loss of $359,831.

The Scam:

1. You post your resume on an employment website (LinkedIn, Monster, ZipRecruiter, Facebook, Indeed, Craigslist, Kijiji, or CareerBuilder) or scammer creates a job posting on one of these websites.

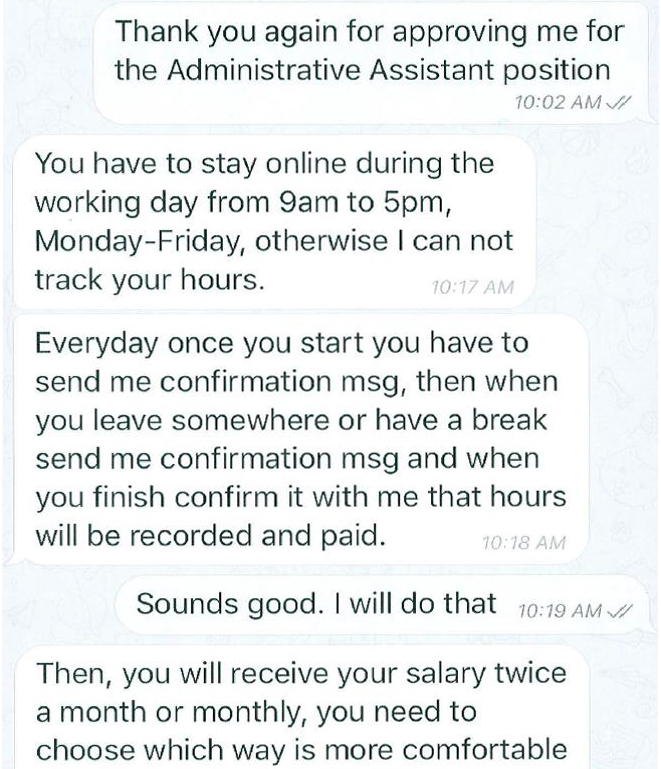

2. Scammer contacts you (they are very friendly, polite and professional) with a job offer and initiates an online interview through email, video chat, or text message. Most often through the following apps: Google Hangouts, Telegram App, texting apps (TextFree app, TextNow app) and WhatsApp.

3. Shortly after the interview, they award you with the job opportunity and provide a number of employment documents to receive your personal and banking information. They will ask for the following information, some of which is not unusual, as most companies need some of the information when they hire you:

- A picture of your Alberta ID card or driver’s licence;

- Bank account numbers and account information (such as passwords)

- A photo of you;

- Social Insurance Number; and

- Home address and all phone numbers

4. You are ‘hired’ in a probationary capacity where you have to prove that you are reliable and suitable for the job. This includes agreeing to message the scammer what you are doing during the day, signing off for breaks to track your work hours; essentially building trust and legitimacy.

Then they tell you that you will use your bank accounts to manage financial transactions until you are no longer in training. It is simply a security risk for their company to give you access to their financial accounts this early on.

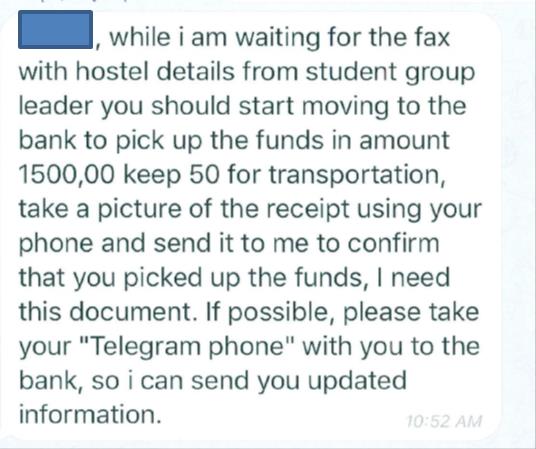

5. Money is transferred to you through e-transfers or a fraudulent business cheque or bank draft is delivered to your home. This money is for ‘expensive equipment and supplies’ for yourself or a client. You are asked to deposit the money immediately and send it to the ‘client’.

6. You have to send the money to the ‘client’ by way of Bitcoin and Ethereum crypto currency, iTunes cards, Interact e-Transfer, vouchers purchased through Flexepin, or direct deposit into a third party bank account provided by the scammer.

7. This will continue until your bank picks up on the fraudulent deposits and transactions or until you determine this job does not feel quite right.

Banks proactively monitor the accounts in their financial institutions and will typically identify fraudulent activity within one or two suspicious transactions. When they do, they lock down your bank account(s) or block your mobile phone(s) so you cannot do any online banking. This is to protect both you and the financial institution from fraudulent activity.

Remember: Anyone can fall victim to these scams. Scammers do this for a living and have many people helping them build their elaborate scams. They take legitimate company and employee names associated to the business and incorporate them into their scheme. Once the scammers disappear with your hard earned money, victims often turn to the company used in the scam only to find out that that company was never involved in the fake job offer.

Online job websites and social media sites are aware of these scams and continually identify and remove fraudulent profiles and job postings. The EPS also works with financial institutions and partners associated to online sites to maintain safe environments for users.

We cannot stop scammers from impersonating businesses or their employees because information and images on the internet can be stolen regardless of what website they are on. So we need to educate our citizens so you can spot the fraud before it’s too late.

Signs a job offer is a scam:

- If it sounds too good to be true, it typically is.

- The offered wage is higher or lower than the average wage for that job; check current wages on the internet.

- You didn’t submit your application to their official career website;

- Your online resume is all they required to hire you.

- The job posting isn’t on the real company's job page.

- They don’t need to meet you in person; most legitimate companies will meet you at least once before hiring you.

- The interview is conducted through Google Hangouts, Telegram App, texting apps (TextFree app, TextNow app), WhatsApp, or no interview at all.

- Emails are sent from free, insecure accounts such as Gmail, Yahoo, or Hotmail.

- Require you to provide personal information, such as your driver’s licence, passport or Social Insurance Number during an interview (this is not needed until later during the background check process).

- You need to supply your credit card or bank account information.

- You need to pay to get the job.

- You are asked to purchase equipment for which you would later be reimbursed by the company. They tell you who to send the money to for the purchase.

- You are required to deposit money into your personal bank account and transfer it to unknown persons/companies

Online job sites can be a safe environment for you to post your resume and apply for your next career endeavour; however it is important for you to take the time to research the offer:

- Do an online search to confirm whether or not the company exists.

- Online business searches are available for companies outside of Canada.

- Consider only accepting employment for companies that are hiring locally.

- Find the phone number for the company you are applying for and call the company to verify whether or not they are hiring.

- Do not send your Social Insurance Number (SIN) or a picture of your SIN card or driver’s licence to prove identity to anyone.

- Do not send your banking information for payroll purposes unless you have confirmed that the company exists and is operational.

- Consider looking for a different job if you are asked to open a bank account, deposit cheques and then send the money to someone else in the form of Bitcoin, iTunes cards, Steam cards, or deposit to a third-party account.

- Confirm with your financial institution that all methods of money transfer to you are valid prior to depositing money or cashing a cheque.

- Wait for the cheque or bank draft to clear before withdrawing or transferring any money.

- Do not cash cheques made out to you that are for an amount higher than the expected dollar value, as they will be fraudulent.

If you have been a victim of this fraud, or any other, scammers will continue to contact you because they know it worked before. Take the following steps to protect yourself and cut off any way for them to contact you:

- If possible, change your phone number(s).

- Contact your bank and credit card companies to close the accounts.

- Contact Equifax Canada (1-800-465-7166 or https://www.equifax.com)

- Contact TransUnion Canada (1-800-663-9980 or https://transunion.ca)

- Contact the companies which have requested an unauthorized credit check.

- Report to your local police (EPS front counters or 780-423-4567)

- Report to Service Alberta – Criminal Investigation Unit (CIU) (1-780-427-7013, toll free or dial 310-0000 first in Alberta)

- Report to the Canadian Anti-Fraud Centre (1-888-495-8501)